how to read your pay stub

UGH What is FICA? Withholding? Social Security?

👀 4minute read

Ok, first things first. You are getting paid! Wahoo!

This is the first step you need to create a new world of financial security and freedom for yourself. Of course we have to celebrate! Pop the champagne – You’re makin’ money!

Now, bring your glass over here and get cozy. It’s time to understand what the heck are all these fees and taxes on your pay stub (most of them are actually good news, promise)

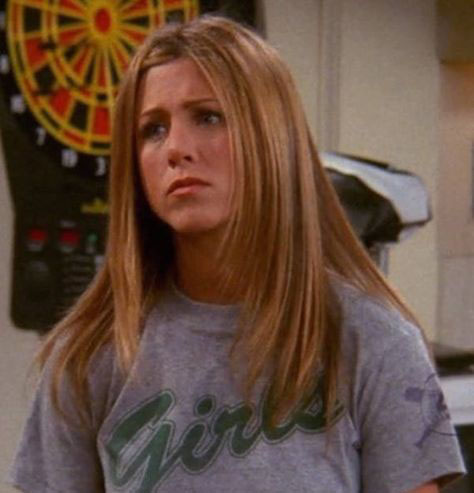

If you looked just as confused as Rachel did when she got her first paycheck, we got you.

FICA

FICA is a tax the federal government takes from every paycheck (yes, every single one) that funds Social Security and Medicare programs. Think of it as your contribution to the United States of America as a law-abiding citizen, as well as funding future you! The only thing you can do is embrace it. The American dream is real.

Social Security

Social Security is a 6.2% tax on your income, and gets set aside for you for when you retire. And you do get it back, don’t worry! Normally at age 66. Consider it a small bonus for your sixty-year-old self. Sexy Sixties? Six for Sixty Six? Ok, ok, we’re getting carried away. Basically, it’s a tax that helps you and in a really long time you will get it back, so don’t forget about it when you’re older.

Medicare

Medicare is a 1.45% tax on your income, and gets used to fund federal healthcare for retirees, people with disabilities, and children. You can decide if you want Medicare as your health insurance after you turn 65. Generally, everything is covered or seriously subsidized, since you’ve paid into it your entire adult life, so it’s not a bad deal.

Federal and State Income Tax

These are your “real” taxes. Annnd there’s no way around it… You gotta pay your taxes.

The amount that gets taken out of your paycheck can be more or less than what you really owe the government at the end of the year. The calculation is based on a few different factors, such as your income, marriage status, and how many exemptions (or allowances) you claimed. That is why it is called “Tax Withholding” – they are estimating how much you will owe come April 15th of next year.

Exemptions

Exemptions and withholding allowances are the same thing. The number of exemptions you enter determines how much of your income gets withheld for taxes.

0 = you want the most amount of tax withheld so you don’t have to owe money – and you will likely get a tax refund in April (safest bet)

1 = you want the least amount of tax withheld so you have more in your paycheck – and you will likely pay the government in April

2 or more = you can only claim 2 or more if you have dependents (aka you have kiddos)

It is really up to you how you want to do it. Just keep in mind if you aren’t withholding enough money for your taxes, you can get penalized. And who wants to pay even more than they need to?

Tax Rates

The federal tax rates can be found here.

The state tax rates can be found here.

Living in New York City or California? Another city tax is added. Gotta pay to live in cool places.

Show me...

Not following? We walk through a W2 so you can see real numbers.

Other Deductions

Your pay stub might also include notes on other deductions, like fees for group insurance or health benefits that you might have through your employer. If you make 401k contributions, it will also show the amount taken from each paycheck.

(WTF is a 401k? Learn about it here)

For Entrepreneurs

Everything we just explained might make ZERO sense to you, because you get 1099s for your work, instead of a paystub. If you work for yourself, or for clients, you gotta figure out how much in taxes you should be paying, and pay the government 4x a year. Ya, extra work.

Use this handy dandy 1040 form to figure out how much you should pay, when and where. Since nothing is automatically withheld from your pay, make sure you set aside at least 12-15% of your earnings for taxes. Otherwise you will *really* be in pain when you have to write a big fat check to the government in April.

And yes, if you are self-employed you still pay into Social Security and Medicare. That’ll all be lumped into your quarterly payments through the 1040 form. Remember, it’s all part of the American dream. And you’re in it!

If you have more questions about your pay stub and the taxes within it, check out the IRS tax estimator to triple-check you got it right.

We've got you (and your wallet)

There’s no one-size-fits-all recommendation to finances. And there shouldn’t be. You have goals and dreams you want to achieve. Your money matters. And you need a financial plan that is personalized to you. Not a blanket recommendation that may or may not help you save more.

That is why we made Penny. Our intelligent calculators will determine the best option for you, with you, powered by you. Take me to the money quiz to see where I am at, and *actually* how to use this advice.

Tags

Penny Finance may earn an affiliate commission if you purchase a partner product or service.

take me to pennyWant money wisdom delivered to your inbox?