stuck with student loans? get rid of them for good

How to pay off your student loans and launch your debt-free life.

👀 6minute read

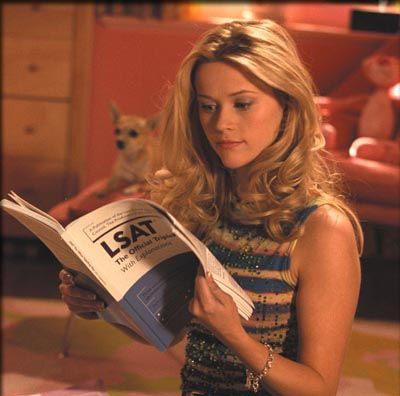

📸 Credit: Pinterest

DEBT. That lovely 4 letter word.

Most days, we’re just as *excited* about debt as you are (aka not at all – can you spot the sarcasm in this intro?)

And then there are days like today, where we get to cover 5 easy, straightforward steps to help you get rid of those damn student loans and onto a debt-free life – and that is truly exciting!

Here’s the thing: You’re not alone.

Women hold two thirds of total student loan debt.

Why? Women make up 56% of undergraduate students and 60% of graduate students.

AKA, women are more educated. But… More Education = More Debt. *Joy*.

(Yup, these are the cold, hard facts. Find it here and here.)

The good news? Just because you got stuck with student loans, doesn’t mean you’ll be stuck with debt forever.

Now, it’s about time we got this debt-free party started.

How do you get out from under that serious pile of loans?

1. Write them all out

Might seem like an obvious first step, but many people skip this.

You can go all out on an Excel spreadsheet, or use good old pen and paper.

Stick with it. De-clutter your brain. List them all out. There is power in knowing.

Student Loan #1 -- $5,628 @ 7.2% with xyz lender

Student Loan #2 – $4,600 @ 5.4% with xyz lender

And so on.

If you’re skipping this step because you’re trying to avoid a panic attack?

Breathe. We’ve been there.

The best way to calm the nerves is to take action and put a plan together.

The first step is knowing where you stand. When you know where you’re at, you can create a plan that actually works for you and your lifestyle.

Don’t have the cash money to pay these off yet? Don’t worry. The goal is to chip away at them, bit by bit, so they don’t snowball on you later on.

P.S. Money can be exhausting, especially when you’re in the red. This is why we built a payoff planner, and Penny Finance quite frankly. To make money moves that give you the freedom to live your best life (debt-free, obvs).

2. Figure out your minimum payment (and pay a little bit more)

This may be the most important step.

Just figuring out what the minimum payment is can be a challenge!

Here is a video of one of our women’s accounts.

Once you find out your minimum payment, pay $20 more than that amount.

Otherwise, you will go to your grave with these loans and never actually pay them off.

Oof. Heaving stuff, we know.

Basically:

Any time you pay only the minimum, you are paying the interest on your loan – and NOT the actual loan balance, which is what we want gone forever and ever and ever.

And while we don’t mind money things being your BFFL, loans are like an ex: we don’t need them hanging around for much longer.

3. Set up auto-pay for whatever you can pay

Auto-pay is your golden ticket to better credit.

Here is the key with auto-pay. The credit agencies look at auto-pay as the “predictable” indicator. If they know the bill is going to get paid, you get brownie points.

We love ways to bump up that credit score.

But also, do you really want to look at those loans every month? Better to set it up so your payments are working in the background, while you are slaying in real life.

Once you find a number that works, set it and forget it.

You can let auto-pay chip away at your loans, and live your life with the confidence of someone who knows their debt is slowly disappearing.

Honestly, even knowing that you put the plan in motion is enough to celebrate!!!

You can revisit it next year (after that raise we know you are gonna get) and bump up that payment when you’re ready.

4. Pay off chunks when you can

If you get that work bonus or a tax refund – do a happy dance!

Then, make a one-time payment to trim down your loan balance.

(Trust us. It feels realllly good to do this. We’ve been there before, remember?)

One request, before you pull the trigger:

Make sure your emergency savings are in a good place.

When it comes to emergency savings, everyone has a slightly different definition of what that means and what your money goal should be.

We calculate that target # for youwhen you create your personalized financial plan, and we help you make sure one action doesn’t cause money problems somewhere else.

For the sake of simplicity, think about it this way:

If you’ve got a stable job, you’ve got a cushion in the bank, and you’ve got those credit cards in order – pay down your student loan!

Which one should you pay first? We walk through an example live.

If you can’t afford to yet, stick with your auto-pay amounts for your loan, and focus on setting yourself up for success in the here and now instead.

For example, say you have credit card debt too. Those interest rates are killer (and double or triple your student loans). So, use that extra money to pay off your credit card – in full – first. Use it for your student loans next time.

If you want to learn more about how debt really works, check out Penny’s courses for more detailed info and to create a personalized money plan built just for you.

5. Keep an eye out for tax benefits

There’s an upside to everything – and student loans are no exception.

On one hand, you’re in debt.

On the other, you might be able to *save* money because of it.

It’s the little things, right?

You might be eligible for possible tax deductions if:

- You make under $100k. How? When filing your tax return.

- You just graduated this year. How? When filing your tax return, if you’re eligible for the American Opportunity Credit (aka straight cash money back in your pocket!)

- You are an educator. How? You could potentially get $17.5k forgiven (aka deleted). This article shows you how.

When you do your taxes, make sure you’re reaping all possible benefits you are eligible for. And use that bonus tax credit to pay off chunks of your loan when you can.

Every small step counts. When you’re in debt, it’s easy to feel overwhelmed. But when you follow these steps, you can rest easy knowing your debt is taken care of (and so are you!)

Not into math? We’re not either. Use our free money quiz calculator to find out how long it’ll take to pay off your loans, based on how much you are paying today.

Not happy with how many years it’ll take? Our How Debt Really Works course takes you through a potential payoff plan to get the results you want, on your schedule.

Tags

Penny Finance may earn an affiliate commission if you purchase a partner product or service.

take me to pennyWant money wisdom delivered to your inbox?