buy now, pay later: good or bad?

Been online shopping lately?

If you’ve seen that button next to the price tag that says, “buy now for 4 payments of $$” and wondered what that was, or how it worked… Today’s post is for you!

👀 5min read

📸: Death To Stock

The “Buy Now, Pay Later” (BNPL) trend has taken the credit world by storm. Fintech companies like Affirm, Afterpay and Klarna are making headlines with million-dollar deals and new ways to pay that are easy and affordable.

But, what are they, really? The FAQs for BNPL are vast.

- Is it safe to use a Buy Now Pay Later option like Affirm?

- Is Afterpay good or bad? How does it compare to Affirm vs Klarna vs Afterpay?

- Does Buy Now Pay Later give you a bad credit score?

- How much is interest for Affirm vs Klarna vs Afterpay?

- And is Afterpay vs Affirm vs Klarna worth it for your wallet?

We answer many of these questions below!

So, the next time you come across that button, you can make spender-savvy decisions -- like the true financial boss babe you were born to be. ;)

(Not feeling the financial boss vibes yet? Join Penny! We show you how to pay off debt, grow your net worth, and make your money work for you. Start with the free money maker quiz.)

Afterpay vs. Klarna vs. Affirm: What are they?

Remember when you bought your first car, or really expensive furniture, and you were given the option to pay in separate installments, with either low or zero interest fees?

You could take the car home that day, but you’re still paying it off over a few months or years.

Buy Now Pay Later companies like Affirm, Afterpay, and Klarna work the same way - except for EVERYTHING.

(Well, almost. You can use their services to buy clothing, groceries, electronics, and much more. As long as your retailer supports it, they’re game.)

And since most of us are often strapped for cash, or looking for the cheapest deals, they became popular right away.

Now, the BNPL sector established a billion-dollar industry. Affirm alone is worth $13B. Klarna is valued at $46B. That’s a loooot of zeros.

Across the U.S., payments made via the buy-now-pay-later method grew to 123% (vs. a measly 2% only a year before). That’s millions on top of more millions of people.

Thanks to the competition, even long-standing credit giants like PayPal and VISA are now revamping their buy-now-pay-later services.

Truth is, this trend is here to stay.

How do they work?

Buy Now Pay Later companies allow you to select different payment schedules to make a purchase.

When it comes to interest, Affirm, Afterpay, and Klarna are mostly (not completely) interest-free.

They’re not quite the same as a credit card, either. In fact, you still need either a debit or a credit card to complete the purchase. But, instead of being charged for 100% of the amount, these companies allow you to “pay later”.

Payment plans depend on which company you roll with, but here are the 3 most popular choices you’ll see at checkout.

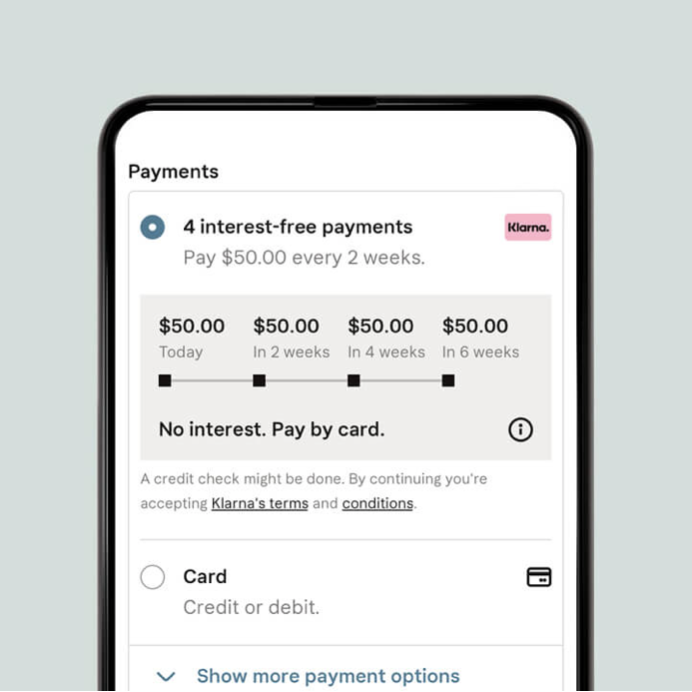

Option 1: Pay in 4 split payments.

This is the most common! You can split any purchase into 4 interest-free payments, every 2 weeks.

Say you are buying a $100 dress. Instead of forking up the full $100 right now, you’ll be charged $25 in 4 bi-weekly payments. You pay $25 now, $25 in two weeks, $25 four weeks later, and $25 six weeks after that. Get it?

All payments are set up auto-magically on the credit or debit card you used to make the purchase.

(Cool? Sorta. We share our thoughts on whether Afterpay is good or bad last. Onto the next options!)

Option 2: Pay in 30 days.

Another option is to pay $0 at the time of purchase, and you’ll be charged the full amount at the end of the month.

Maybe you reallllllllly want to order that dress for the wedding you’re in, buuut you only get paid at the end of the month. And timing-wise, that’s cutting it close, since you need to wait for shipping, and then you gotta make sure it fits!

With this option, you can buy the dress, and your card will be automatically charged at the end of the month. No interest.

IF at the end of the month, you don't have enough money on your debit card, OR your credit card is maxed out, they will start charging you interest.

Option 3: Pay in 6 months or more.

The last option is to pay for your purchase in 6 months or more.

PLS DON'T DO THIS. THIS IS A LOAN. IT IS NOT INTEREST FREE.

If you don't have the money now, and you won’t have it in a few days, or whenever your paycheck drops in…Please don't buy it.

Borrow from your BFF, or find a creative way to zhuzh up that old LBD in your closet. Instead of paying interest for 6 months, save it to buy new shoes.

Do they impact your credit score?

Short answer: it can increase, decrease or have no impact on your credit score -- depending on the BNPL company. (according to this article.)

Regardless: BNPL are short-term loans and get closed once you pay off the balance. 15% of your FICO credit score is determined by length of credit history. If you utilize BNPL often, this can bring down the average age of your credit history considerably.

AND AS ALWAYS, if you miss a payment = bad credit. Afterpay has stayed out of the credit world altogether. Klarna and Affirm report missed and late payments. IN SUM:

YES, it will affect you. Missed payments always have a negative impact on your credit score.

Plus, you’ll also be charged 10-30% interest. Ouch.

So, should you use them?

We are not fans of anything that negatively impacts your credit score.

We are also not super-fans of this form of payment. (Not because the companies aren't legit, or that they are a scam -- which they certainly are not!)

We’re not in love with this trend, because we think it skews the way you think about spending.

Are you going to remember 4 months later that you owe that $25 on that dress? Probably not.

And depending on how much you’re spending, and how often, this could get verrryyy dangerous, very fast.

You get ALL these things immediately, at a quarter the cost or for $0… And granted, that’s awesome. But NOT if you start to spend more money without consciously even thinking you are spending more money!

After all, we don’t want you to accidentally end up with 5 different $100-dresses for that wedding, only because “they were just 4 payments of $25!”... And waaay over budget.

See what we mean?

Bottom line:

Yes, these companies are trustworthy. But be careful with over-spending and protect your credit score.

When you ask, “is Affirm vs. Afterpay vs. Klarna worth it?”

Think of it like chocolate cake. Or sweets, in general.

Yes, they’re delicious and we love them.

But eat too much of it, and you end up with a stomach ache, sugar crash, or worse. No thank you. We like to enjoy our dessert AND feel good after. And we want the same for you.

Signing up for these services once in a while is fine, if you’re really in a bind (or you’re awaiting a paycheck). But doing this all the time is NOT recommended for your wallet.

Of course, that doesn’t mean you can’t ever go shopping…

Apply the mini-budget method, so you can buy that dress guilt-free ;)

--

We've created affordable financial advice for women. Start with our free money quiz - it'll show you the two most important numbers to growing wealth.

Want more money #inspo? Follow us on Insta @startwithapenny

Tags

Penny Finance may earn an affiliate commission if you purchase a partner product or service.

take me to pennyWant money wisdom delivered to your inbox?