running your own biz

You’re here to make that money. We’re here to show you how.

At Penny, we build fully customized and personalized financial plans that tell you how, actually how, to make those money moves. No one-size-fits-all advice here. All in 10 mins or less. Because learning how to manage your money shouldn’t be so hard. It should be accessible, interwoven. Little bits of walking the right way and taking the necessary action - just like your business.

We have 40+ interactive financial plans that tell ya what to do.

And today we are so so excited to launch the newest plan.

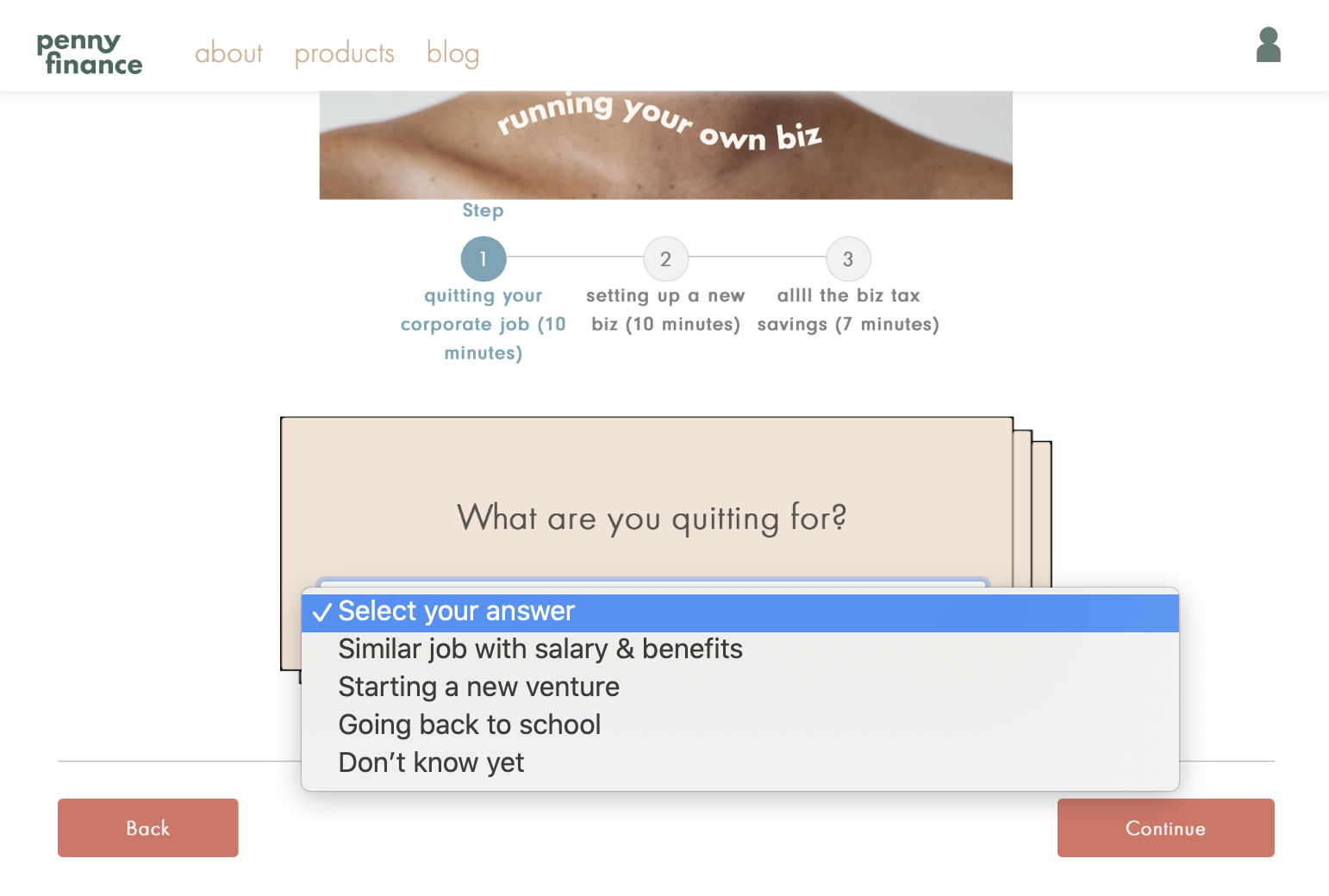

Meet our newest financial plan: running your own biz!

Calling all our entrepreneurs - ladies who are dreaming of quitting their jobs to do their own thing. WE SEE YOU. Almost 50% of new entrepreneurs are women -- freakin finally, one place in this world that is equal.

What we cover:

- quitting your corporate job (should you? what will it cost you?)

- setting up a new biz (LLC, S corp, Sole proprietorship, or C corp?)

- allllll the tax savings (what should your quarterly tax payment be? what can you actually deduct?)

Why:

Why don’t they teach us these things in school (eye roll emoji)?? You can find endlesss blog posts describing all the ways in which you should approach the matter. Information is great but too much information can be mind boggling. We like to be a bit more direct.

Plug in your numbers and characteristics of the life + business you dream of and we’ll give you an *actual* answer in black and white -- in just a few mins. No more guessing. You tell us who you are and what you want and we’ll give you our very best, well-informed suggestions to stay aligned with what works for YOU.

And because we are alllll about getting the trade secrets out into the open, here are the top 3 questions we get from our entrepreneurs / soon-to-be entrepreneurs.

Top questions:

Q&A: What the heck do I need to set aside every quarter to pay the government?

Short answer - Your revenue minus your tax deductible biz expenses divided by 4. (Don't run, plz, we built a calculator for you so you don't need to do the mental calculus).

P.S. These are estimates, you should obviously consult an accountant!

Q&A: Should I quit my job and start my own thing?

Asks everyone everywhere!!! First, read our post on quitting your job. Second, its alllll about the numbers. How much to live your life? How much to fund your biz? How much in tax savings? How much are you leaving in company benefits that you gotta make up for? Brain buster -- we built a calculator to answer it for you. Because that's what we do.

Q&A: Should I incorporate as an LLC or S Corp or neither?

It depends -- on 11 different things actually :) The short answer is if you have 1 or more people on payroll, S corp is best.

What else we want you to know:

Have you ever met a business owner - especially a new business owner - cool as a cucumber just hanging around like “nahh I AM GOOD, business is running itself, piece of cake”? NO (crazy talk). That’s because entrepreneurialism is an active form of art. Art must be created. Creation takes thought, planning and EFFORT.

To live life with your heart as your livelihood is a brave endeavor. We suggest you enter it with a sense of awareness and intentionality. A big picture knowing, a moldable plan. You are in control of it because after all - you are a real life human being who created this thing called business so why should it ever be running you?

Ten minutes or less a day - hell a week even! - to learn the big stuff on running your own biz (maybe even more?!).

And suddenly all these minutes stick in your brain for a lifetime and you’ve died a financial whiz, a business owner who THRIVED and a badass woman in control of her own money. Yes please to that!

Check out our full-suite of financial plans, so you can make those money moves.

Tags

Penny Finance may earn an affiliate commission if you purchase a partner product or service.

take me to pennyWant money wisdom delivered to your inbox?