the ultimate guide on how to get a tax refund

What could possibly be more boring than taxes? Watching the grass grow? Yeah, agreed.

But here’s the thing: doing your own taxes is the quickest way to learn your numbers and set yourself up for financial success! You’ll feel more money-wise, more confident, and more adult than when you bought your 1st set of bedsheets for your new place.

Today we uncover the ins & outs on all things taxes, including rates, brackets, deductions, and more importantly: how to get a tax refund. Because a great way to start the year is with a little extra money in your pocket. Right?

👀: 6min read

📸: Shevoke x Molly King

How do I know my tax rate?

Your tax rate is the percentage you have to pay the US government come tax season.

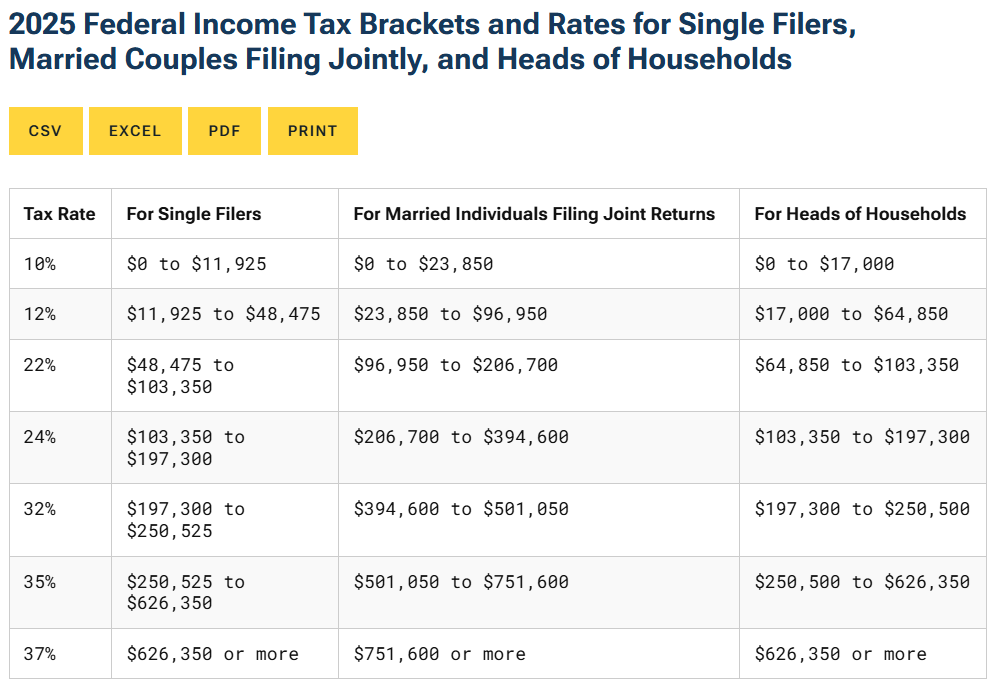

2025 Federal tax rates can be found here.

State tax rates can be found here.

Tax rates are calculated based on which tax bracket you fall into. More info on this below.

What are Federal tax rates and tax brackets?

Let’s talk federal rates first. They’re less straightforward, but once you get this, the rest of our tax-talk will be as smooth as avo on toast.

There are 7 federal tax brackets with 7 corresponding tax rates.

Your tax brackets are based on your:

-

taxable income (not gross income) and

-

your filing status (single, married, etc).

PS. Taxable income = your total income, minus all your deductions. (scroll down for deductions 101)

The good news is: The U.S. has a progressive tax system.

This means that being in a tax bracket doesn’t mean you pay that rate on EVERYTHING you make.

The government decides how much tax you owe by dividing your income into chunks – AKA dividing it into separate tax brackets.

Then, each chunk of money gets taxed at the corresponding tax rate.

FOR EXAMPLE:

Say you’re a single person filing taxes…

First, you start at the lowest possible tax rate (which is 10% for anyone who makes between $0 to $11,922 in taxable income), and then you “move up”.

If you make $20k per year, the tax rate of 10% is applied to the first $11,925 of your income.

After that, the next portion of your income is taxed at the next tax bracket – which is 12%.

This continues for each tax bracket, up to the top, until you’ve hit your total taxable income.

This is what makes federal taxes sooo confusing. Unless you fall into the lowest bracket (AKA less than $10k taxable income per year), you’re working with multiple rates.

Naturally, most people fall into 2 or more brackets, so your tax rate % changes.

Plus, you still gotta add STATE tax rates too!

If this makes your head spin, take a deeeeep breath. Most electronic tax filing systems calculate this for you. Also, you can easily tackle this tax math with Penny’s smart calculators or a DIY Excel spreadsheet.

Why are taxes so expensive?

Great question! We broke it down for you here.

How do I get a tax refund?

Money back from the government? …um, YES please!

Refunds can occur for many reasons. Here’s how to get a tax refund, the easy way.

Most commonly, a refund happens when you pay more tax throughout the year than you actually owe.

Why would this happen?

As an employee, you choose your withholding status (or exemption, same thing).

Remember that stack of paperwork you filled out when you were first hired? Ya, that one!

Part of that paperwork told your employer how much tax to withhold from your paycheck every pay period (someone’s gotta pay your taxes!).

If you choose 0 = that’s the most amount of tax that’s withheld and paid on your behalf.

This is when you’ll likely “over-pay” and get a refund come tax time!

But that’s not the only way you can get a tax refund.

Introducing: Deductions.

What are tax deductions?

“Deductions” is a fancy word for expenses that help reduce the amount of income that you have to pay taxes on. YASSS!!!

And if you have lots of expenses that qualify, but you “overpaid” your taxes, you might get a tax refund.

The most common tax deductions are:

- Student loan interest ($2,500 max)

- Mortgage interest

- Child tax credit ($3,600 per kid)

- Tuition ($2,500 max)

- Donations to charity

- 401k or IRA contributions

- HSA contributions

- Solar energy purchases

Everyone has to pick ONE OPTION from these two choices:

- a standard deduction: a flat dollar, no-questions-asked reduction in your income (90% of people do this – because it’s a check the box thing – no adding up receipts or anything, everyone is eligible to get this NO MATTER WHAT)

\ OR

- itemized deductions: where you pick-and-choose your own expenses to reduce your income (yup, you guessed it, you gotta enter all the exact numbers and provide proof to lower your tax bill)

What should you do?

Think big picture – did your deductions add up to MORE than:

- $12,550 (if single)

- $25,100 (if married) or

- $18,800 (if you had kids)

If not: go with the standard – you literally check a box and reduce your taxable income. Easy like Sunday morning.

It’s pretty hard to have enough deductions to get over $12k, honestly. So, unless you have a ton of kids, are an entrepreneur, or are currently in school, you’ll likely take the “standard deduction.”

Can I pay less taxes every month?

YES! Simply change your withholding/exemption status on your paycheck. See how you can do this here - scroll down to item #2 on changing your exemptions.

Who should file my taxes?

YOU should! Seriously! It may take a little extra reading, but the results are sooo rewarding.

It’s FREE on IRS and state websites – BUT they certainly aren’t holding your hand here, so we encourage you to do your “homework” beforehand. (Since you’re here, we know you’ll ace it!)

If you want a little extra help, use Turbo Tax. But don’t let them fool you, it’s almost never free. The more complicated your return, the greater the cost.

You may want to lean on an accountant if you own your own business, you’re an entrepreneur, or just have a lot of moving parts (like stock options).

We know tax season can get a little overwhelming, and we don’t want you to miss out on how to get a tax refund.

Sign up for Penny today and get personalized advice from a digital financial advisor in your corner.

Have more tax questions?

Ask us anything on Insta @startwithapenny

Looking for a link? No need to scroll:

Tags

Penny Finance may earn an affiliate commission if you purchase a partner product or service.

take me to pennyWant money wisdom delivered to your inbox?