first-time homebuyer programs: where to start?

Are you buying your first home, but not sure if you can afford it or where to start? You just hit an internet jackpot: this post is for you!

Here, we cover:

- what do you need as a first-time homebuyer?

- the TL;DR on first-time homebuyer programs

- how to choose the right one for you

- first-time homebuyer program examples

- resources and links to save (scroll to the bottom!)

We also answer the ultimate first-time homebuyer question: do you really need a 20% down payment? (no, but you’ll want one.)

👀 5min read

📸: Death to Stock

What do you need as a first-time homebuyer?

A typical homebuying checklist includes:

- a credit score of 720 or higher

- a 20% down payment (more on this later)

- an AGI (adjusted gross income) of FOUR times above your annual mortgage payment

- two years of tax returns (gotta prove you have the money)

Obviously, these things can be really hard to achieve!

The 20% down payment is especially tricky. Let’s say you want to buy a $500,000 home. That’s a $100,000 down payment – who the heck has $100k just lying around? Most people can’t afford that. (If you can, awesome! Either way, that’s a BIG number.)

Fortunately, that’s where first time homebuyer programs come in.

What is a first-time homebuyer program?

First-time homebuyer programs are loans, incentives, and grants that aim to decrease the barriers to ownership for people who are purchasing a home for the first time.

Each one can support you at different income levels, homebuying stages, and more. Some examples:

- Lower down payment requirements (as low as 3-5% compared to the 20% standard)

- Loans with flexible credit score requirements

- Assistance with closing costs

- Government loan programs (FHA, VA, USDA)

- Grants

- Incentives for veterans, active military, doctors, firefighters, educators and healthcare workers.

There are over 2,000 homeownership programs available across the country at the city, state, and federal level. So if you don’t think you qualify for one, there is a high chance you’ll find another first-time homebuyer program option that’s right for you.

Plus, homebuyer programs are not limited to first-homes. Over 38% of programs also include “repeat homebuyers” who acquired a home in the last 3 years. Cool, right?

How to choose the right homebuyers program?

We’ll be blunt. There’s no easy way to choose. Because there are SO many options!

Here’s how you can narrow it down.

First things first: what’s your budget?

If you plan on owning a home one day, a great place to start is your own financial wellness. What’s your income? Can you afford a mortgage? Do you have enough for a down payment? How much are you willing and able to pay on all that? And so on.

Penny has a great bite-sized educational course on Home Buying that’s automatically included with a membership. It’s a great tool to help you plan your next steps, start saving, and get a head start as a first-time homebuyer with easy, digestible education.

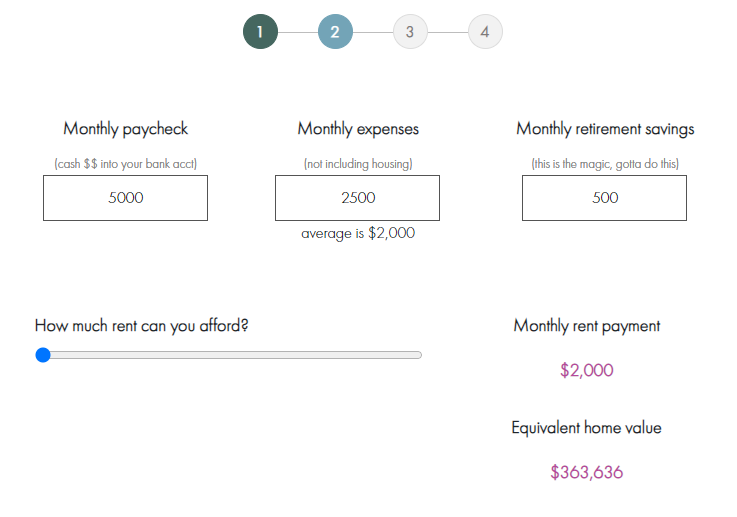

Here’s a rent vs. mortgage calculator sneak peek:

>> Not a member. Not a problem. You can book a free 15min intro call with us to see if Penny's right for you.

Next: do your research!

Which first-time homebuying programs do you qualify for? Each state or city can have different programs and grants available. The federal government has theirs. And there are slightly different income and credit requirements for most.

For example, many programs enable homebuyers to pay only 3% down mortgage (instead of the 20% recommended).

- A “Conventional 97” loan is available for both first-time and repeat homebuyers – and has no income limits.

- However, a “Fannie Mae” or a “Freddie Mac” loan is only for those who meet certain income requirements.

Plus, you could qualify for more than one program or be eligible for additional grants or tax credits. So, always do your research.

You’ll find more program-specific info (and links) in the “Resource” section at the end of this post.

Then: plan it out.

Once you identify your budget and which programs you might qualify for, it’s time to plan your next steps.

- Are there deadlines associated with specific programs? → Add it to your calendar.

- Are there eligibility requirements you haven’t met yet, but can? → Get on it!

Some programs require that you complete an online or in-person first-time homebuying class. Random, right? Your realtor or lender should be able to guide you in finding one.

The goal is to help keep yourself accountable, and empower you to navigate tough financial decisions with ease. (Kind of like what Penny does for your wallet.)

Do you actually need a 20% down payment?

20% of the home’s purchase price is the ideal down payment required to buy a house.

At least, that’s the golden rule. If you put down less than that without qualifying for a first-time or repeat-buyer program, you will most likely have to pay mortgage insurance -- which can add up to hundreds of $$ a month. (Yep, they get your money one way or another.)

>> Pro tip: Keep your down payment savings in a high-yield savings account for at least 3 months prior to wanting to buy a home, and maximize your earnings.

Resources for first-time homebuyers

Between homebuying, budgeting, investing, saving for retirement, and just doing your best to live your life – money planning can be a lot to handle on your own. Thankfully, you don’t have to.

Need to plan it all out? Sign up for Penny.

First, we’ll help you discover your wallet’s untapped potential. Then, we’ll help you stay on track with personalized money insights and monthly check-ins, delivered straight to your email inbox. Your first home might be closer than you think!

Government loan programs:

- FHA = Federal Housing Administration Loans

- VA = Department of Veteran Affairs Loans

- USDA = United States Department of Agriculture Loans

- Bookmark this page to read the latest on first-time programs

- Read this to learn about Biden's $25k Down Payment Toward Equity Act

Other resources:

- 3% Down Payment Mortgages for First-Time Home Buyers

- More Resources for Down Payments and Eligibility

- Have course requirements to meet for your grant or program? Here’s the approved list of courses (US Department of Housing and Urban Development)

--

At Penny Finance, our goal is to provide easy and digestible financial education so you can increase cash flow today, and retire with wealth tomorrow. Curious? Click here to learn more.

Tags

Penny Finance may earn an affiliate commission if you purchase a partner product or service.

take me to pennyWant money wisdom delivered to your inbox?