beyond the great wealth transfer

Reading Beyond the Headlines

You’ve likely seen the headlines about the Great Wealth Transfer. The believers have placed big bets, going so far to state that forthcoming generations will become “the richest in history” via the funds predicted to trickle down. The naysayers, however, aren’t convinced in the transfer’s efficacy, citing the rising cost of long term healthcare and longer lifespans as additional factors.

At Penny Finance, we researched beyond the headlines to uncover what the wealth transfer will really mean for the next generation. And the facts show that yes, a great amount of money will change hands as the Boomer generation ages––around $84 trillion, according to a report by Cerulli. But who, exactly, will these funds be going to?

Firstly, women. A McKinsey study finds that by 2030, American women are expected to control much of Baby Boomer assets. They state that women are living longer than men, and increasingly making the financial decisions for their households.

But this wealth will not be divided evenly amongst the general public. Only 15% of American adults expect to receive an inheritance in the next decade. This means that the majority of Americans will not. And those who receive the money likely already have it, as 68% of the wealth transferred will go to households with at least $1mm in assets.

Asking The Right Questions

How much wealth is truly passed down, and who it goes to, will be proven in time. But at Penny, we believe that we might be asking the wrong questions about The Great Wealth Transfer.

In all the research, one thing is unanimous: with or without the luck of familial fortune, women are coming into their financial power.

Instead of asking how to serve those who are coming into wealth, we posed a different set of questions to investigate. How does the next generation of women want to manage their money? And how can financial services institutions meet the needs of the next generation of women both with and without wealth?

These questions, and more, are answered within our below report.

Shifting Our Collective Money Mindset

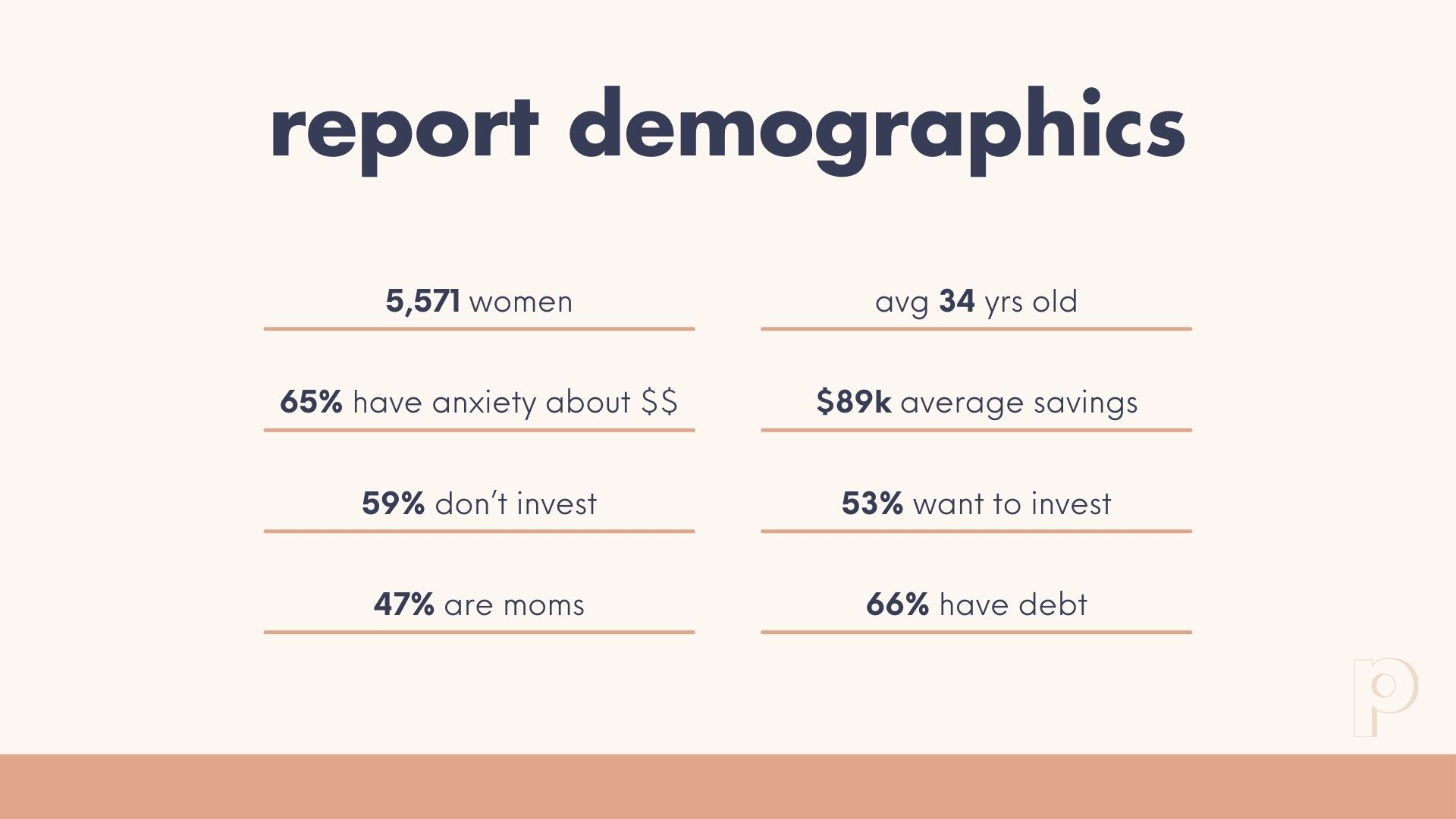

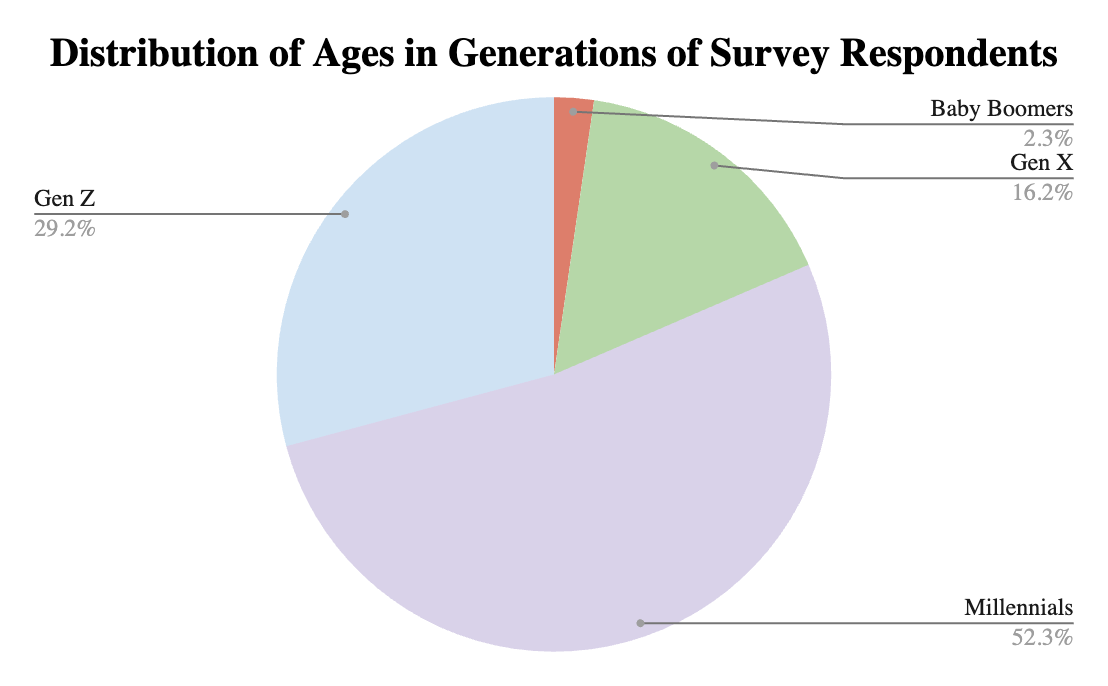

We surveyed 5,571 women between the ages of 18-74 on their financial standings, sentiments around money, and overall fiscal goals. And while our report will delve deeper into the differences between the four generations––Gen Z, Millennials, Gen X, and Baby Boomers––what is striking is that the barrier to financial freedom is unilateral across the board: anxiety. 65% of survey respondents selected ‘anxiety’ as their top feeling around money.

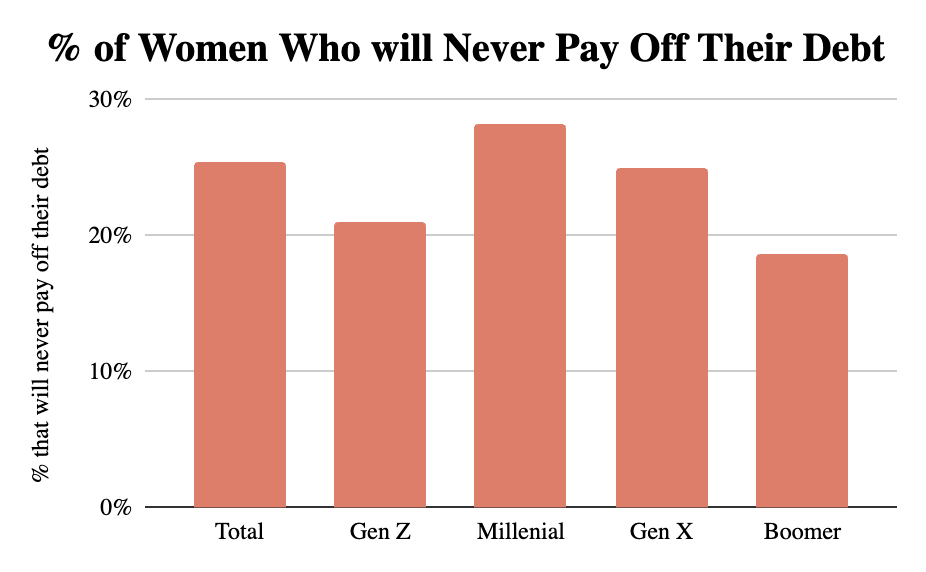

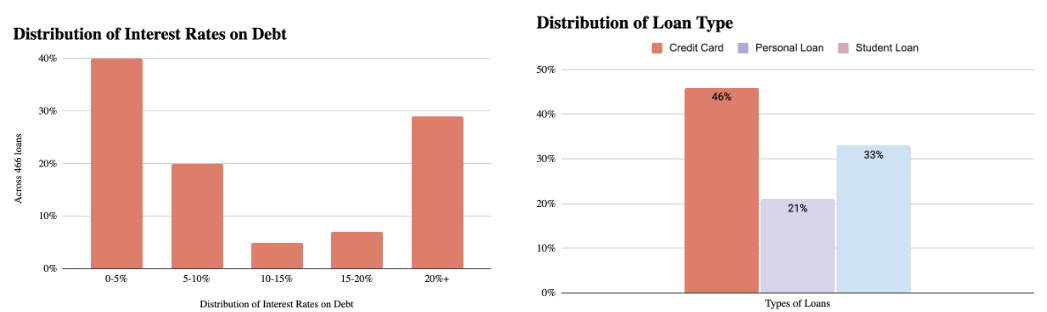

Given that 66% of respondents have debt (and among those 25% say they will never be able to pay it off in their lifetime), this sentiment isn’t surprising.

This mindset around money is at the core of why catering to women as a specific segment of the population is crucial. While women have gained––and still may acquire––more wealth than ever, they still have limiting beliefs about money.

The good news is that inspiring financial confidence in women is possible if we can understand and serve their unique priorities, circumstances, and needs.

What Do Women Want?

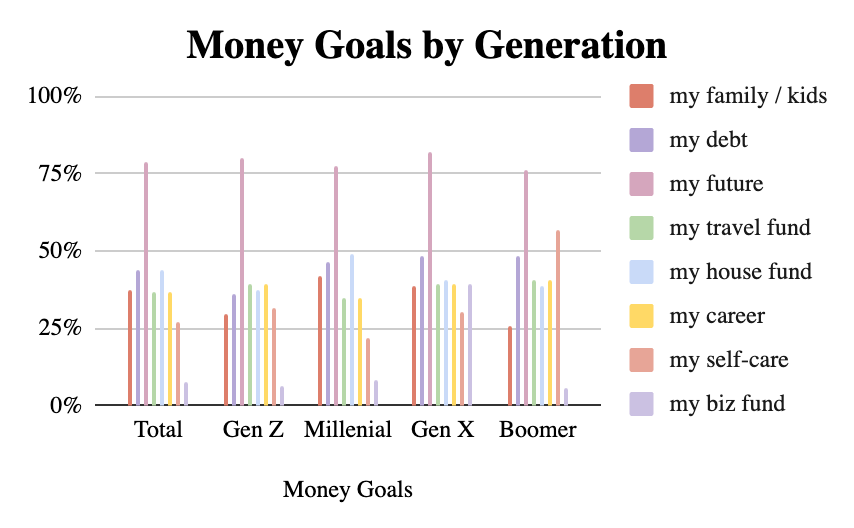

From Gen Z to Boomers, we see that women are future-minded with their finances. When we look at the goals of each generation, three trends emerge: all want to have enough to fund their future, pay off their debt, and own a home.

Contrary to their stereotype, Millennials, overwhelmingly, are prioritizing a house fund (49%) as well as family and kids (42%). This makes sense, considering that 47% of survey respondents are moms, and another 30% say they would like to be moms one day.

It’s no wonder that the majority of respondents reported anxiety as their top feeling around money. When your financial goals are so fundamental, yet feel so unattainable––due to debt and other factors we will get into––money becomes a major stressor in your life.

It’s clear that all generations know what they want with their money. But do they know how to get there?

Working To Live?

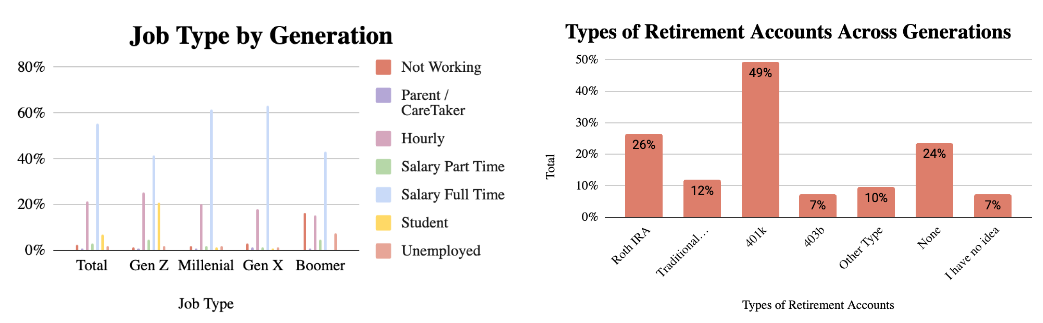

62% of Millennials are salaried full time employees, versus 43% of Boomers. This is a significant difference––much of the next generation of women has access to employee-sponsored retirement accounts, HSAs/FSAs, and other wealth building tools. But are they taking advantage of this?

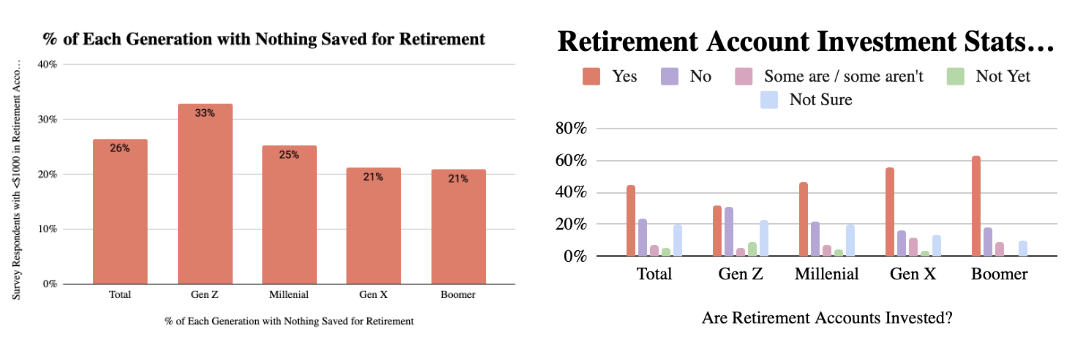

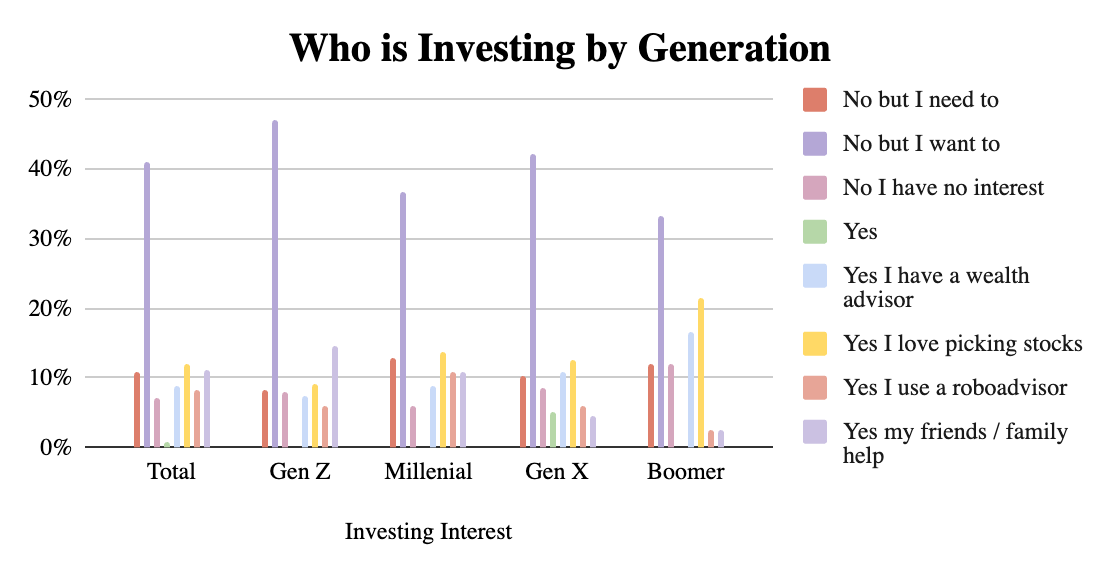

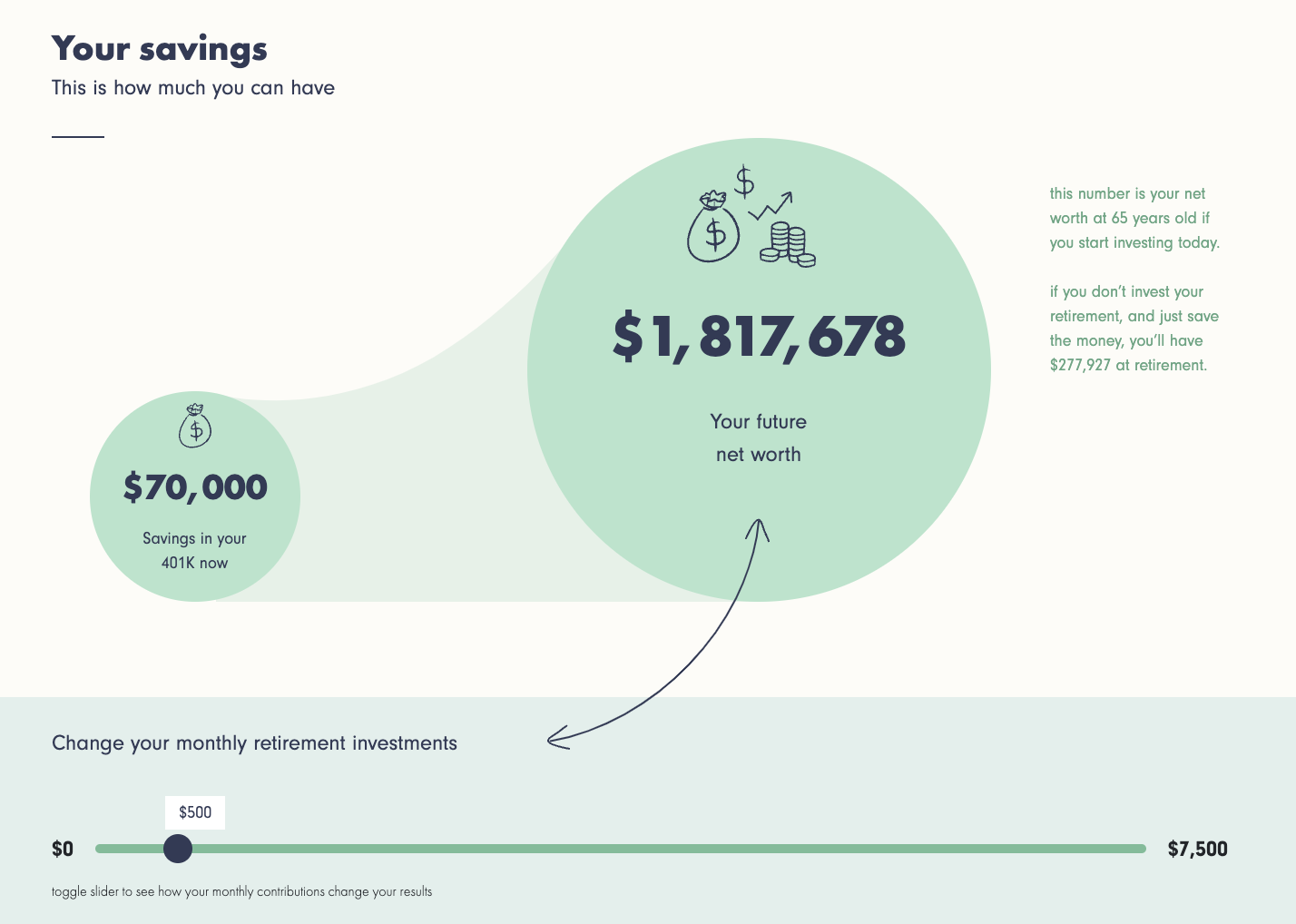

One of the most concerning findings in our report is that a significant amount of Millennials (22%) and Gen Z (22%) say they are NOT investing their retirement accounts. For all generations, 100% of their existing retirement accounts should be invested. The only factor limiting someone from investing their retirement account is awareness and education.

This gap shows that the next generation is not investing at higher rates. They are not wealth building at the same rates as their parents and grandparents.

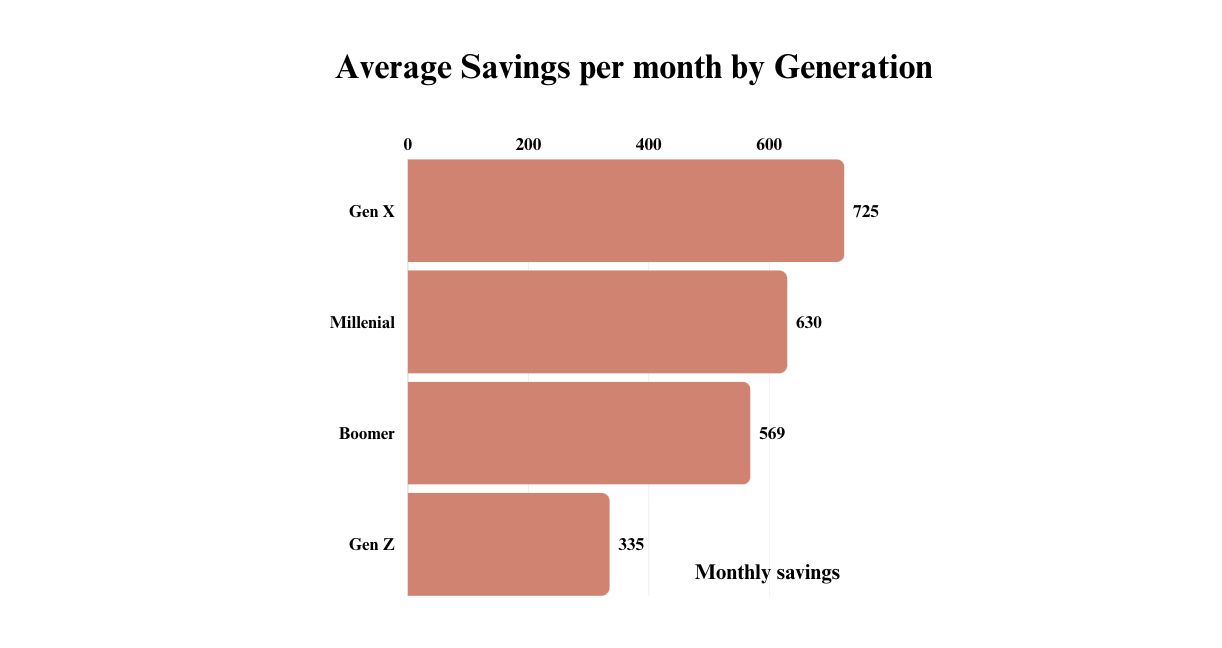

Now, we can’t forget about Gen X (also known as the sandwich generation). These 44-59 year olds are often charged with taking care of both aging parents and children. Of all generations we cover, they report having the most debt, yet we also see that over 25% have a unique financial goal of contributing to their “biz fund.” If Gen-X is starting their own businesses, they will likely need the most support from financial providers––to consolidate/refinance their debt, to take out small business loans, and to roll over their retirement accounts.

25% of women don’t have anything saved for retirement, and we cannot blame that entirely on cost of living. We see in the chart above that every generation is saving money each month. And we know that especially at a younger age, saving a few hundred dollars per month can move the needle on growing wealth over time.

This is an area of opportunity for both employers and financial services institutions. Roth and Regular IRAs are going to continue to grow in popularity, based on job type, job changes, and retirement consolidation. We have a giant responsibility to ensure the bare minimum is contributed and invested in a retirement account, across all generations.

Together, we can ensure that all generations are not only aware of the resources at their disposal, but truly understand the impact of investing today on their retirement many years down the line.

How NOT To Die With Debt

Student debt, credit card debt, and personal loans are not built to be paid off. And among the 66% of respondents who have this kind of debt, 25% say they will never pay it off.

*This data includes student loans, credit card debt, and personal loans. It does not include mortgages or car loans.

However, the data shows there’s more to the story. For example: although 25% of Gen X say they will never pay off their debt, they’re also saving $725 every month on average.

What would happen if they reallocated $100 of those funds to debt? Or $200? Even small adjustments to monthly payments can shave years off of debt.

Proper guidance paired with understanding of each individual’s goals means that it’s within our power to help women cut down debt repayment periods from never to someday soon. At Penny, we see it all the time––our members have cut their time until debt free by an average of 5 years.

But that is not enough. We asked women when they want to pay off their debt. The average is 4.1 years. This means we need to work to find a way to shave 23 to 32 years off their debt payment plan.

Where to start? Interest rate. Can we help the 41% of women with loans at 10%+ APRs refinance, consolidate, or pay down these debts to reallocate those interest dollars and large monthly payments to retirement?

Intent To Invest

The majority of survey respondents (59%) are not investing––even though 53% say they want to invest. This is a huge issue. Women retire with 1/2 the wealth of our male counterparts, and this is largely because we aren’t investing at the same rate.

As the data shows, it’s not because women do not want to invest. Gen Z, in particular, shows great interest (47% say they want to invest). So how can we bridge the gap between intent and action?

It’s up to us to educate and illustrate the impact of investing for women––to tell them exactly how their hard earned dollars can grow over time, so they don’t have to work forever, or depend on a wealth transfer that may or may not come, to achieve financial freedom.

Closing the Wealth Gap

Throughout this comprehensive report, women shared their financial goals and feelings, as well as the top challenges they face. Although the next generation of women are employed, motivated, and accomplished, they are burdened by greater debt than previous generations, anxious about their finances, not fully taking advantage of the retirement resources, and hesitant to invest.

The next phase of gender equity will depend not on the wealth passed down to the few, but on the ability for the majority of Americans to pay off debt and begin investing at the same or higher rates as previous generations.

The only question that remains is this: what will you do today to help close the wealth gap?

What now?

- Bring Penny to the women at your organization: We work with credit unions, community banks, and other financial service companies to help women get out of debt, into investing, and retirement-ready. Book time with us here.

- Become a part of the Penny Community: Become a member and to get access to personalized financial insights and bite-sized educational modules that will set you up for financial success, no matter what your financial circumstances. Sign up here.

- Attend a FREE masterclass: Join us for a free monthly masterclass covering everything from surviving student loans to making your first investment. Check them out here.

- Pay it forward: No matter how old you are, what gender you are, what generation you are in: If you are investing, planning for retirement and feel good about your financial future, share this report with others so they can do the same.

ABOUT PENNY FINANCE

Penny Finance is an online financial planning platform built for women-first. Through personalized education and insights, we help members get out of debt, into investing, and retirement-ready.

Penny Finance partners with credit unions and financial services institutions to offer financial well-being programs, education, and technology to support the next generation.

SURVEY METHODOLOGY

This poll was conducted between April 12, 2022 and December 31, 2023 among a sample of 5,571 female adults. The survey was conducted online at www.penny-finance.com/quiz.

Tags

Penny Finance may earn an affiliate commission if you purchase a partner product or service.

take me to pennyWant money wisdom delivered to your inbox?